Jon Winkelried & TPG: Insights On Finance & Insurance - Latest News

Is the financial world undergoing a period of unprecedented transformation, where the lines between traditional sectors are blurring? The rise of alternative asset managers and the convergence of investment banking and insurance markets suggest a paradigm shift in the financial landscape.

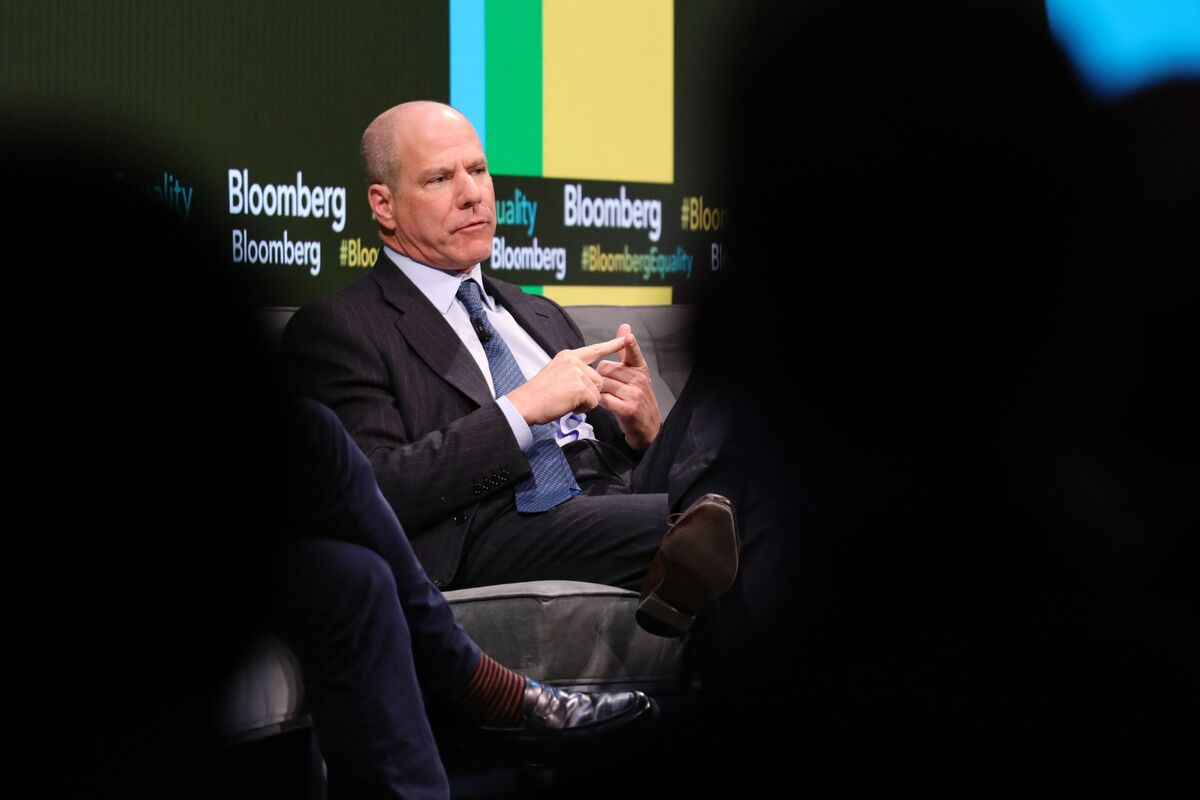

Jon Winkelried, a name that resonates with success and innovation across the financial and insurance sectors, offers a compelling perspective on this evolving terrain. As the Chief Executive Officer and a partner of TPG, one of the world's most prominent and admired alternative asset managers, Winkelried is at the forefront of these changes. He is no stranger to the inner workings of high finance, having spent 27 years at Goldman Sachs before transitioning to his current role. His insights are highly valued, especially given the complex economic environment and its impact on the investing landscape, spanning various products and geographies.

| Full Name: | Jon Winkelried |

| Born: | 1959 (Age 65 as of 2024) |

| Nationality: | American |

| Education: | (Information not available in the provided text) |

| Current Position: | Chief Executive Officer and Partner, TPG |

| Previous Roles: | Former Co-President of Goldman Sachs |

| Career Highlights: |

|

| Known For: |

|

| Key Contributions: | Shaping strategies of prominent insurers, navigating the convergence of the alternatives and insurance markets. |

| Reference: | TPG Official Website |

The strategic moves of firms like TPG are indicative of this shift. The firm's acquisition of the credit shop Angelo Gordon, along with its lending and financing teams, has positioned TPG to capitalize on opportunities in the insurance sector, as Winkelried himself stated on December 5, at Goldman Sachs U.S. in 2024. This forward-thinking approach highlights the dynamism of the financial world and the importance of adapting to new market realities.

- Bill Oreilly Photos Newsnation Show More Latest Updates

- Melissa Joan Harts Faith Journey Insights Beliefs

The interview on the Goldman Sachs Exchanges podcast provided further insights into Winkelried's perspectives. He already holds a substantial stake in TPG, with around 340,000 Class A shares and over 18 million partnership units, which underscores his vested interest in the firm's future success and his commitment to its strategic direction.

One significant aspect of the current financial landscape is the growing interaction between alternative asset managers and insurance companies. Insurers are increasingly recognizing the potential to compete more effectively by generating higher returns. Winkelried notes that "tectonic shifts" are reshaping the private markets and spurring consolidation among alternative asset managers, a trend he discussed on the Goldman Sachs Exchanges podcast. He observes a clear trend towards consolidation and concentration within the industry. The largest pools of capital are actively seeking to expand their scope and influence, a sign of the ongoing evolution within the sector.

Uncertainty is a formidable obstacle to transactional activity and capital flows in the financial markets. The ability to navigate this uncertainty, manage risk, and identify promising opportunities becomes even more crucial. The insights provided by executives like Winkelried, who have deep experience across different facets of the financial industry, are very valuable in this regard.

- Princess Dianas Hivaids Handshake A Viral Moment Legacy

- Flowood Drug Company Your Trusted Pharmacy In Flowood Ms

Winkelried's departure from Goldman Sachs, where he retired at 49, at the pinnacle of his career is a testament to his leadership abilities. His subsequent venture into the world of alternative asset management as CEO of TPG has allowed him to showcase his strategic vision and innovation prowess, especially in the fast-evolving environment in the financial and insurance sectors.

The insights provided by Winkelried during interviews and speeches offer a glimpse into the strategies being employed by leading alternative asset managers. His career trajectory, from investment banking to private equity, and his understanding of the convergence of the alternatives and insurance markets makes him a significant figure for anyone interested in the evolution of the financial landscape.

TPG's focus on the insurance opportunity, backed by strategic acquisitions and an understanding of the competitive landscape, exemplifies the proactive approach required to thrive in the financial industry. His ability to assess the economic environment and its impact on investments demonstrates his strategic acumen.

In the interview at Nexus 2025, Winkelried also discussed the need for alternative asset managers to adapt to a consolidating market and manage larger capital pools. This focus on strategy suggests the key to success in the years to come. The recent convergence of the alternatives and insurance markets is another important evolution in the landscape.

The insights from Winkelried's interviews, speeches, and the strategic moves of TPG offer a valuable understanding of the current economic environment and future trends in the industry. As a prominent figure with a proven track record, Winkelried's leadership is helping shape the future of finance. His influence extends beyond the firm he leads, impacting the entire sector as a whole.

Jon Winkelried is one of the most admired alternative asset managers, and his influence extends to the strategic decisions of prominent insurers and the shaping of the industry. The strategic moves of TPG, under Winkelried's direction, demonstrate the ability to capitalize on emerging trends. His focus on navigating market uncertainties while identifying opportunities is a key aspect of his success.

Winkelried's career arc provides valuable lessons for aspiring leaders. He left Goldman Sachs at an early age to embrace new challenges, and his leadership at TPG showcases his adaptability and vision. His strategic initiatives are likely to continue shaping the financial world, highlighting the importance of his leadership in a changing industry.

The evolution of the financial markets will continue to unfold, and Winkelried's perspective offers an insight into the complexities and opportunities of the era. His track record, coupled with the strategies being implemented at TPG, places him at the forefront of innovation and leadership in finance.

The future of the financial industry will undoubtedly be marked by ongoing change. The strategic focus of leaders like Winkelried will be instrumental in defining the contours of the sector. For investors, industry professionals, and anyone interested in understanding the evolution of finance, his insights are indispensable.

The acquisition of Angelo Gordon, along with the strategic moves being undertaken, demonstrates TPG's focus on the insurance sector. The leadership of Jon Winkelried provides the necessary vision for TPG. His insights into the convergence of the alternatives and insurance markets offer a lens through which to view this transformation. This shows the dynamic nature of the financial world and the leadership needed to shape it.

Jon Winkelried's journey is a testament to the ability to lead and innovate. From Goldman Sachs to TPG, he has helped shape the financial world. His insights are essential for understanding the industry, and his actions will influence the direction of finance for years to come.

The evolving landscape of finance presents unique challenges. However, under Winkelrieds leadership, TPG is well-positioned to thrive in the years ahead. His experience in both investment banking and the alternative asset management space provides a unique perspective on the trends impacting the global economy.

The financial world is undergoing a period of significant change, and Jon Winkelried's career underscores the importance of visionary leadership. From his early days at Goldman Sachs to his current role at TPG, he's played a crucial part in shaping the landscape. The strategic direction of TPG and his comments on industry trends provide a roadmap. For those interested in finance, his experiences offer a valuable insight into the evolution.

Winkelried's move from Goldman Sachs and then into the role of CEO at TPG is noteworthy. His insight and leadership provide guidance in the ever-changing financial environment. The strategies and the acquisitions that TPG has undertaken serve as a testament to the innovative path that the financial world is currently on.

Uncertainty is the enemy of progress, and the financial world is not immune to it. The need for leaders like Winkelried, who have expertise in both the insurance and investment sectors, is more important than ever. His leadership and guidance during times of uncertainty are key.

The acquisition of Angelo Gordon is one of the ways that TPG is positioning itself to succeed in the industry. With a clear understanding of the markets and his influence, Winkelried is helping shape the financial future. His understanding of the convergence of the alternatives and insurance markets offers a fresh insight into the industry's transformation.

Detail Author:

- Name : Hertha Fahey III

- Username : russell23

- Email : stan36@maggio.com

- Birthdate : 1993-12-02

- Address : 3056 Adams Alley South Raymundotown, CT 02641-7744

- Phone : 810-602-1402

- Company : Lockman, Lockman and Langosh

- Job : Compensation and Benefits Manager

- Bio : Qui fugit omnis consequatur vitae a rerum eaque. Nihil dolorem ut temporibus numquam non nulla praesentium. Aut quo ut non commodi soluta. Sapiente libero et aut.

Socials

facebook:

- url : https://facebook.com/carter2007

- username : carter2007

- bio : A tenetur omnis nihil sunt dicta aut.

- followers : 4691

- following : 823

linkedin:

- url : https://linkedin.com/in/rubiecarter

- username : rubiecarter

- bio : Asperiores eos sit nemo excepturi.

- followers : 3866

- following : 2616