Wisconsin Unclaimed Property: Find & Claim Your Funds!

Could you be sitting on a hidden treasure? Across Wisconsin, millions of dollars in unclaimed property await their rightful owners, and you might be one of them.

The state of Wisconsin, recognizing the potential for residents to unknowingly leave assets unclaimed, enacted the unclaimed property law in 1970. This pivotal legislation established a centralized system, offering a single location for Wisconsin citizens to search for and, if applicable, claim missing funds and assets. This initiative aimed to simplify the process, making it easier for individuals to reconnect with what rightfully belongs to them.

The mechanics of this system are relatively straightforward. After a period of inactivity, typically ranging from one to five years, Wisconsin businesses are legally obligated to transfer all unclaimed money, stocks, and the contents of safe deposit boxes to the Department of Revenue (DOR). This process ensures that these assets are safeguarded and made accessible to their owners. The DOR then becomes the custodian of these unclaimed holdings, responsible for maintaining and, ultimately, returning them to their rightful claimants.

- Hailey Welch Onlyfans Rumors The Hawk Tuah Girls Rise

- Unveiling Muriels Wedding Insights Toni Collettes Transformation

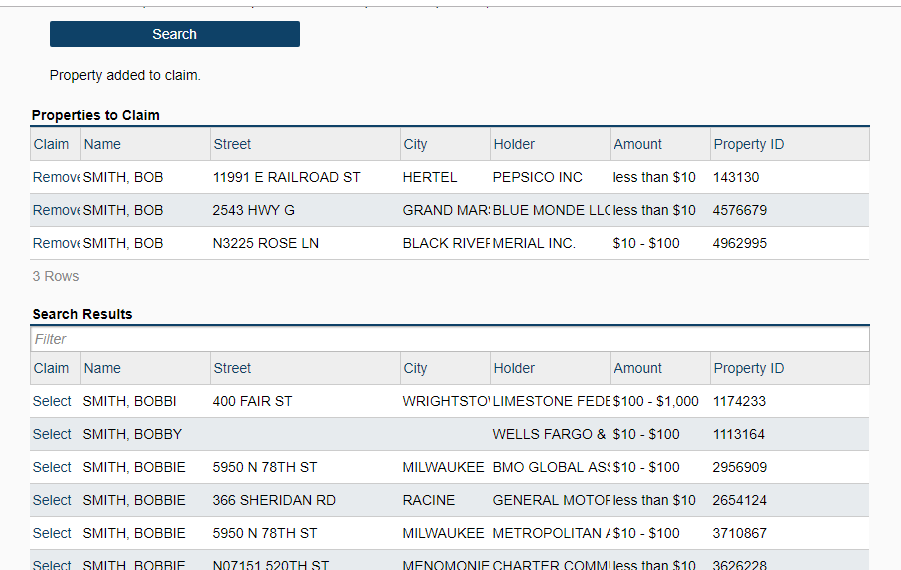

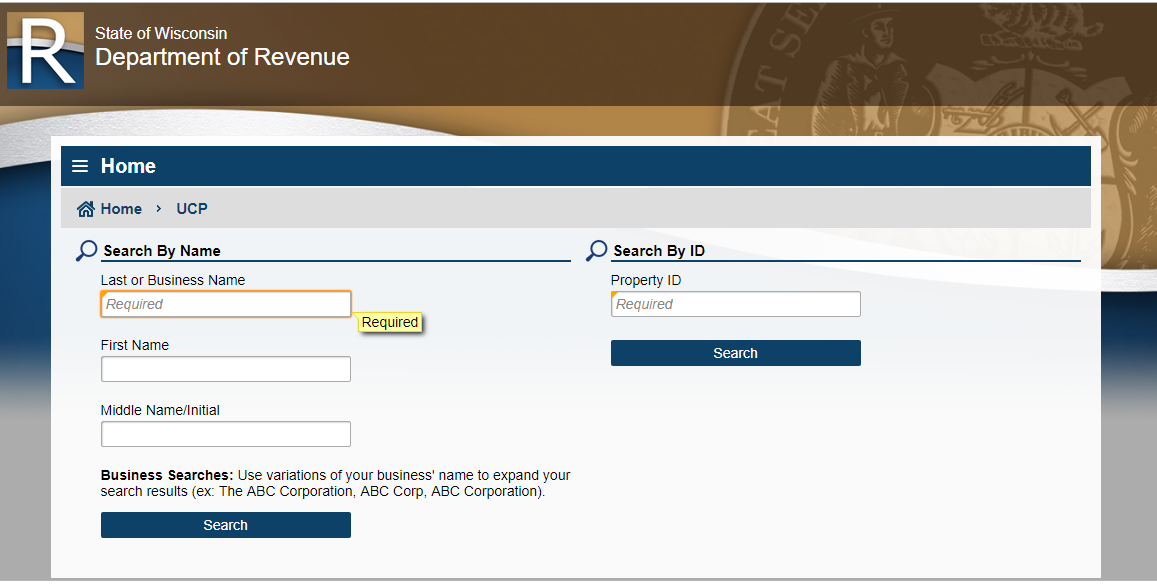

To initiate a claim, several key steps are involved. Individuals seeking to recover unclaimed property should first navigate to the Wisconsin Department of Revenue website's dedicated unclaimed property page. Within this portal, a search function allows users to explore potential claims. This search functionality is accessible by entering either a name or a property ID number, but not both simultaneously. This specificity ensures accurate results and streamlines the search process.

Once a property is designated as unclaimed, the state employs several strategies to reconnect it with its owner. These include advertising the unclaimed property and the owner's name to increase visibility. Additionally, the DOR matches the names of unclaimed property owners with public records, and utilizes tax records to try to locate the owners. The state maintains unclaimed funds indefinitely, and there is no time limit for claiming these assets, as long as proper documentation is provided. For instance, funds can be paid in full to the claiming spouse if the property is in the names of a married couple who filed a joint return in Wisconsin in the past year. However, if the other owner is still living, you may only be paid your portion of the value of the unclaimed property. According to section 59.66(1) & (2) of the Wisconsin statutes. The purpose of this state statute is to return money to its rightful owner.

The Wisconsin Department of Revenue (DOR) plays a central role in administering the unclaimed property program. It is the point of contact for all inquiries and claims related to unclaimed assets within the state. Further, the DOR provides resources and guidance to help individuals understand the process and submit their claims effectively. The program is supported by statutory mandates outlined in sections 59.66(1) and (2) of the Wisconsin Statutes, which emphasize the ultimate goal of returning property to its rightful owners.

- Capricorn Gemini Compatibility Love Sex Life Discover Now

- Ubs Arena Parking Your Ultimate Guide To Location Options

Unclaimed property can encompass a diverse range of assets. This includes unclaimed bank account balances, uncashed checks, public benefits, tax refunds, back wages, and even veterans insurance funds. The potential sources of unclaimed property are vast, underscoring the importance of a proactive search to identify any potential claims.

Businesses operating in Wisconsin are subject to specific reporting requirements. They are obligated to review their financial records annually to identify any funds, securities, or tangible property that has remained unclaimed for the required dormancy period. These businesses, often referred to as "holders," must then file an annual report and subsequently transfer the unclaimed property to the state. The DOR provides detailed guidance and resources, including Publication 82, the Unclaimed Property Holder Report Guide, and instructional videos, to assist businesses in meeting their reporting obligations.

The process of claiming unclaimed property requires careful attention to detail and the provision of necessary documentation. Claimants are advised to gather as much supporting documentation as possible to substantiate their claim. This typically includes government-issued identification and the claimant's Social Security number to verify identity. Furthermore, the DOR provides clear instructions on acceptable documents and the submission process to ensure a smooth and efficient claim review.

The state's commitment to reuniting property with its owners is further exemplified by its comprehensive outreach efforts. The DOR actively advertises unclaimed property to increase public awareness. This can involve various methods, including media campaigns, online listings, and partnerships with community organizations. Furthermore, the DOR collaborates with other agencies and organizations to locate potential owners and facilitate the claim process. For instance, the County Treasurer's office in Marathon County, located at the courthouse in Wausau, Wisconsin, is a vital point of contact for unclaimed property related to that county.

For those seeking assistance with a claim, it's essential to understand the relevant legal framework. The purpose of the state statute, as outlined in section 59.66(2), is explicitly to return money to its rightful owner. This legal underpinning provides a strong basis for the unclaimed property program and underscores its commitment to protecting the financial interests of Wisconsin residents.

When a deceased individual's assets are involved, additional steps may be necessary. In cases where a will was not left, claimants will be required to answer questions about the decedent's heirs as part of the online submission process. The "Transfer by Affidavit," also available on the State Bar of Wisconsin website, is one tool to use in such instances. The "Affidavit of Heirship" is also available on the State Bar of Wisconsin website to provide guidance.

The state's commitment is also demonstrated through their outreach efforts. The DOR actively advertises unclaimed property to increase public awareness. For example, The department of revenue said last month it returned about $6.6 million in unclaimed funds and property to its rightful owners. In addition, In 1970, Wisconsin state enacted the unclaimed property law. This law gave a centralized location which would allow state residents to search and claim their funds and other assets. The goal of the law was increasing the number of legal property owners who got reunited with their unclaimed funds by the state. Also, the department of revenue said wednesday it recently returned about $8.2 million in unclaimed property to its rightful owners.

For those seeking to locate unclaimed funds, the Wisconsin Department of Revenue website offers a user-friendly search portal. By visiting dor.unclaimedproperty.wi.gov, individuals can initiate a search using either their name or, in some cases, a property ID number. It is no longer at the office of the state treasurer.

Detail Author:

- Name : Adolfo Romaguera MD

- Username : purdy.donny

- Email : elvie.goodwin@hotmail.com

- Birthdate : 1989-03-25

- Address : 83007 Lizeth Islands Austinborough, MA 26152

- Phone : 479.297.6634

- Company : Dietrich-Deckow

- Job : Engine Assembler

- Bio : Et minima ullam quia sunt praesentium. Consequuntur quisquam recusandae voluptas ipsum nobis reprehenderit corrupti. Et natus officiis eum et quas eum.

Socials

linkedin:

- url : https://linkedin.com/in/kennith_official

- username : kennith_official

- bio : Distinctio sed voluptate sapiente adipisci.

- followers : 1895

- following : 1738

instagram:

- url : https://instagram.com/kennith9373

- username : kennith9373

- bio : Dolore rerum perferendis eius. Vel aut voluptas aspernatur atque magni.

- followers : 4103

- following : 2309

twitter:

- url : https://twitter.com/metzk

- username : metzk

- bio : Tempore et nobis veritatis. Vitae numquam a aspernatur aut adipisci ut excepturi. Sint repellendus quia provident quo.

- followers : 3975

- following : 2633

facebook:

- url : https://facebook.com/kennithmetz

- username : kennithmetz

- bio : Modi id accusantium voluptatem nulla maxime voluptatem pariatur.

- followers : 4127

- following : 1333