Wisconsin Unclaimed Property: Find & Claim Your Funds Now!

Could you be sitting on a financial windfall you don't even know about? In Wisconsin alone, the state is currently holding over $600 million in unclaimed property, just waiting to be claimed. This staggering sum represents forgotten assets, lost funds, and dormant accounts all belonging to rightful owners like you.

Wisconsin's unclaimed property law, enacted in 1970, established a framework to reunite residents with their lost assets. The Wisconsin Department of Revenue (DOR) acts as the custodian of this property, holding it until the rightful owners come forward to claim it. This program, designed to protect citizens' financial interests, has returned millions of dollars to Wisconsinites over the years. Businesses are mandated to turn over unclaimed assets, including money, stocks, and safe deposit box contents, after a period of inactivity, typically one to five years. This helps to ensure that these assets don't simply disappear, but are held securely until the legitimate owners can be found.

The process of claiming unclaimed property in Wisconsin has been streamlined to make it accessible and efficient for residents. You can initiate your search and file a claim directly through the DOR's website at dor unclaimed property (wi.gov). The user-friendly platform allows individuals to easily search for unclaimed property by entering their name or business name. Through the Wisconsin DOR My Tax Account, you can also register tax accounts, file taxes, make payments, check refund statuses, and manage audits, providing a centralized portal for various financial needs. The DOR also works in conjunction with the Department of Children and Families, which manages the unclaimed child support program and posts an updated list on its page.

- Toni Collette Muriels Wedding From 22 To Icon Google Discover

- Jon Voights Pride Angelina Jolie Grandkids Success

Understanding the dynamics of unclaimed property is crucial to initiating your search. Property becomes unclaimed through various avenues. Common scenarios include dormant bank accounts, uncashed checks, forgotten stock holdings, and the contents of abandoned safe deposit boxes. Uncashed checks from county and municipal entities, often older than one year, are also considered unclaimed property. When these funds are reported, municipal treasurers inform the county treasurer, who then provides public notice of the unclaimed funds in local newspapers and online. This process gives people the opportunity to make claims.

The DOR's role is multifaceted. It not only acts as the custodian of unclaimed property but also actively seeks to locate the rightful owners. This is achieved through a range of methods, including advertising unclaimed property, searching public records to match property with owners, reviewing tax records, and maintaining an online, searchable database of unclaimed property. The DOR's annual process of locating, verifying, and returning assets reflects its commitment to safeguarding citizens' financial well-being. The DOR also collaborates with other state agencies, municipalities, and even the federal government to collect debt, meaning your claim refund may reveal debts owed to other government bodies, as detailed in your notice of claim.

The DOR has implemented a voluntary disclosure program to encourage businesses and organizations not in compliance with Wisconsin's unclaimed property laws to voluntarily come forward and report unclaimed property without incurring penalties. While this program was offered for a limited time, its effectiveness has led to its permanence, starting June 1, 2024, providing a pathway for businesses to rectify any past non-compliance. Holders of unclaimed property are required to remit the property to the Department, who acts as the custodian for the property. This ensures that the unclaimed assets are preserved until they can be returned to their rightful owners.

- Chip Joanna Gaines Family Photos Updates From The Fixer Upper Stars

- Barbara Bushs Marriage To Craig Coyne A Deep Dive Into Their Life

The Unclaimed Property Program is overseen by the Wisconsin Department of Revenue (DOR). It functions to reunite citizens with property that has been lost or forgotten. The DOR's unclaimed property program is run to return assets to their rightful owners. The DOR actively seeks to locate the rightful owners of unclaimed property, utilizes multiple methods like advertising, searching public records, and maintaining an online database. The law was enacted in 1970 to enable residents to search for missing funds in one place.

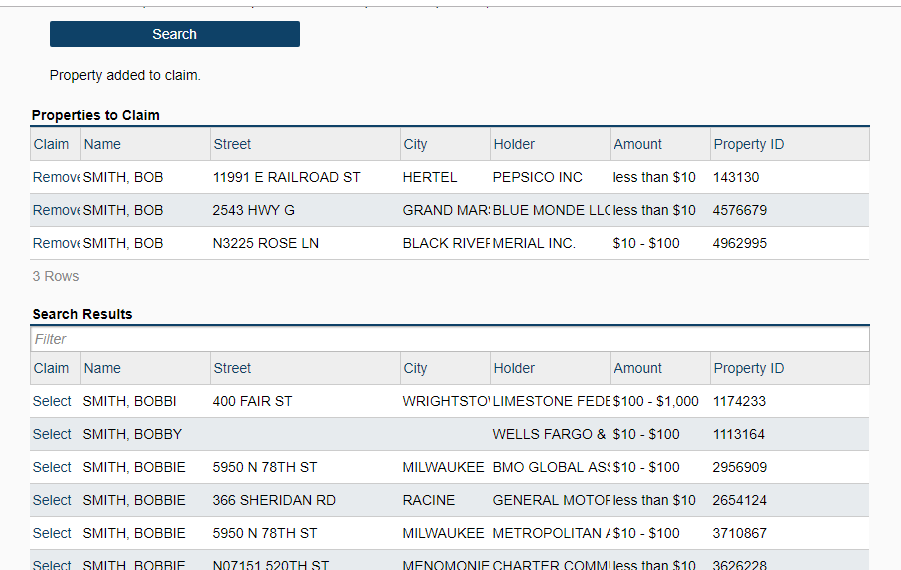

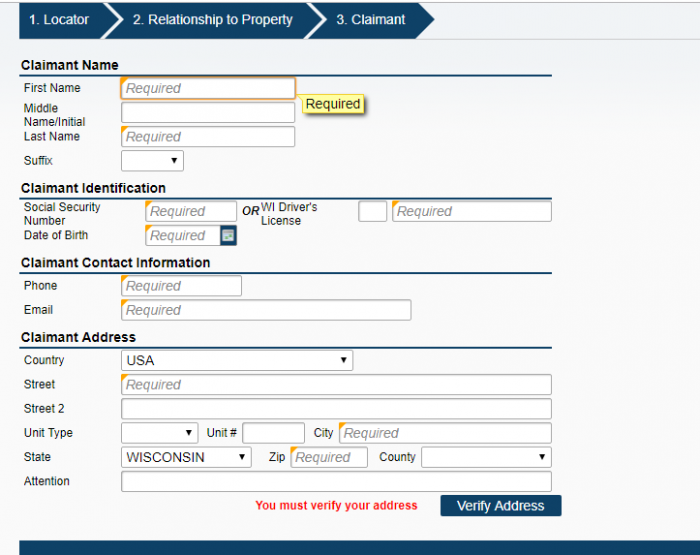

To initiate a claim, visit the Wisconsin Department of Revenue website's unclaimed property page and click on the "Search & Claim" box. You can include up to 20 properties per claim; however, each property owner requires a separate claim. The DOR strives to make the process as streamlined as possible. Choosing the correct relationship type and attaching all necessary documentation to your claim helps expedite the review and approval process. You will be required to submit documents, to support your claim as the legal owner of unclaimed property. Please refer to the claim form instructions to determine which documents are required. The information of the National Association of Unclaimed Property Administrators® is not allowed to be copied or reproduced in any capacity without express written consent.

The DOR website serves as a central hub for all things related to unclaimed property. The missingmoney.com is the official unclaimed property website of the National Association of State Treasurers. The federal agencies like NAUPA and HUD do not receive claims. Instead, these agencies only help people locate unclaimed property, after which they must follow the state's claim policy. Searching the site is simple, and the search results will detail the available unclaimed assets. For married couples who filed a joint return in Wisconsin, the funds may be paid in full to the claiming spouse. If the other owner is still living, you may only be paid your portion of the value. For any questions or assistance, you can provide your claim number or confirmation number in your email.

The Unclaimed Property Program operates to return unclaimed assets to their rightful owners. The program is available to any Wisconsin resident who may have funds, stocks or property which have been forgotten about or lost. The DOR's commitment to safeguarding financial assets. In fact, the $9.9 million in matched claims represents just a small portion of the unclaimed property in Wisconsin. With the right approach and the right information, you could potentially recover funds that you may not have known you had, or even forgotten about.

After August 15th, 2025, all claims for funds must be made to the Racine County Treasurer's Office at 730 Wisconsin Ave Racine WI 53403. Such funds will be held by Racine County for up to 10 years. You will need to fill out an affidavit of ownership and provide a valid photo ID to claim your funds. Changes effective after April 2, 2025, are designated by notes. The Current Brown County unclaimed funds list as of January 31, 2025, is maintained. The Wisconsin DOR My Tax Account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. The department of children and families manages the unclaimed child support program and updates the list that is posted on this page.

Frequently Asked Questions:

How does property become unclaimed? Property becomes unclaimed through various means, including dormant bank accounts, uncashed checks, forgotten stock holdings, and abandoned safe deposit boxes.

How do I report and remit unclaimed property to the department? Businesses are required to report and remit unclaimed property to the Wisconsin Department of Revenue. The process involves identifying and reporting specific property types based on their dormancy periods.

Why does Wisconsin have an unclaimed property law? Wisconsin enacted the unclaimed property law in 1970 to provide a centralized location for residents to search for missing funds and to protect their financial assets.

What happens to unclaimed property when the Department of Revenue cannot locate the rightful owner? The Wisconsin Department of Revenue holds unclaimed property as a custodian until the rightful owner is found. If the owner cannot be located, the property remains in the state's custody.

How long does it take to get unclaimed money in Wisconsin? The time it takes to receive unclaimed funds varies. The speed depends on factors like the complexity of the claim, required documentation, and the volume of claims being processed.

Detail Author:

- Name : Mr. Jadon Quigley MD

- Username : ztillman

- Email : parisian.angie@bauch.info

- Birthdate : 1984-01-25

- Address : 71037 Murazik Mission Lorenzaville, NM 09309-2512

- Phone : 1-872-898-1179

- Company : Vandervort Group

- Job : Semiconductor Processor

- Bio : Voluptatem atque sit asperiores voluptas cupiditate officiis rem enim. Dolorem eaque eum quia perspiciatis. Molestias pariatur aliquam sed cumque.

Socials

instagram:

- url : https://instagram.com/ray_haley

- username : ray_haley

- bio : Et eum nulla et eos qui et ab. Hic et dolores tempore. Qui possimus quis quam est qui labore.

- followers : 4476

- following : 2891

twitter:

- url : https://twitter.com/rhaley

- username : rhaley

- bio : Sunt suscipit debitis asperiores et porro aut. Maxime accusantium ut et. Hic error consequuntur veritatis accusamus distinctio eius sequi.

- followers : 6847

- following : 2367

facebook:

- url : https://facebook.com/rayhaley

- username : rayhaley

- bio : Accusantium quis nisi molestiae qui.

- followers : 5528

- following : 1649

linkedin:

- url : https://linkedin.com/in/ray_haley

- username : ray_haley

- bio : Magni repellat quos aut laborum.

- followers : 5135

- following : 189