Pinellas County Property Tax: Deadlines, Payment Options & FAQs

Are you a Pinellas County property owner, wondering about the intricacies of your tax obligations? Understanding the deadlines and payment options is crucial to avoid penalties and ensure youre contributing to the vital services that shape our community.

Pinellas County property owners must be diligent in their tax payments, as the deadline looms. Your property tax payment is considered delinquent if the tax collector does not receive it by April 1st. This is a critical date to remember, as missing it can lead to added expenses.

Once your taxes are past due, be prepared for additional charges. Interest and other fees are added to the outstanding balance, increasing the overall amount owed. Florida law is clear: property owners cannot submit partial payments for delinquent real estate taxes. The full amount must be settled.

- Hurricane Aiyana Bartender Marine Biologist Shaking Up Nightlife

- Indiana Mylf On Tiktok What You Need To Know

Fortunately, the Pinellas County Tax Collector provides various convenient ways to pay your property taxes. Paying bills is now easier than ever with just a few clicks online. The digital platform enables you to manage and make payments on one convenient platform anytime, and anywhere.

Property taxes can be a considerable financial commitment, so it is very important to use these accessible and manageable methods of payment. The county allows the use of credit cards, with a payment limit set at $99,999.99. Be aware that while this option offers flexibility, convenience fees are collected by the vendor, not the tax collector.

Another payment option is available by electronic check (eCheck). This method utilizes your bank account and routing number. The best part? ECheck payments are free, offering a cost-effective way to fulfill your tax obligations. This flexibility in payment methods is designed to assist taxpayers in meeting their responsibilities without undue burden.

- Tom Felton Draco Malfoys Life Beyond The Harry Potter Films

- 670 The Score Your Chicago Sports Radio Hub News Updates

For those who prefer the digital route, paying bills online is a breeze. You can easily pay with electronic check (echeck), or credit card and manage your payments in one convenient platform anytime, anywhere. It is very easy to navigate on a computer or other handheld device.

On Thursday, the Pinellas County Board of County Commissioners approved the fiscal year 2025 budget. The county has been working hard to provide additional financial relief to taxpayers. The county commission has been steadily reducing the property tax rate again.

The Pinellas County Tax Collectors website provides a comprehensive overview of property taxes in Pinellas County, and offers several convenient options for payment. You can view your account, switch to paperless billing, and update your address with the property appraiser. Information on tourist development taxes is also available.

Your tax bill is considered paid as soon as you submit payment. It will reflect as paid on the Pinellas County Tax Collectors online system. However, it may take up to five business days for your bank to process and reflect online payments. Plan accordingly to avoid any confusion or late fees.

If you prefer to pay by mail, make your check payable to the "Pinellas County Tax Collector" and send it to the designated P.O. Box address.

The Pinellas County Tax Collector will accept online payments for 2024 real estate taxes until 4:30 PM EST on May 30th, 2025. This provides ample time to fulfill your obligations via the online portal.

In 2025, on Monday, January 13th, Pinellas County will...

If you file your TPP return with us by April 1st, you will be eligible for a property tax exemption of up to $25,000 of assessed value (section 196.183, Florida Statutes). However, the exemption does not apply in any year that a taxpayer fails to timely file a return that is not waived per section 196.183(5), Florida Statutes.

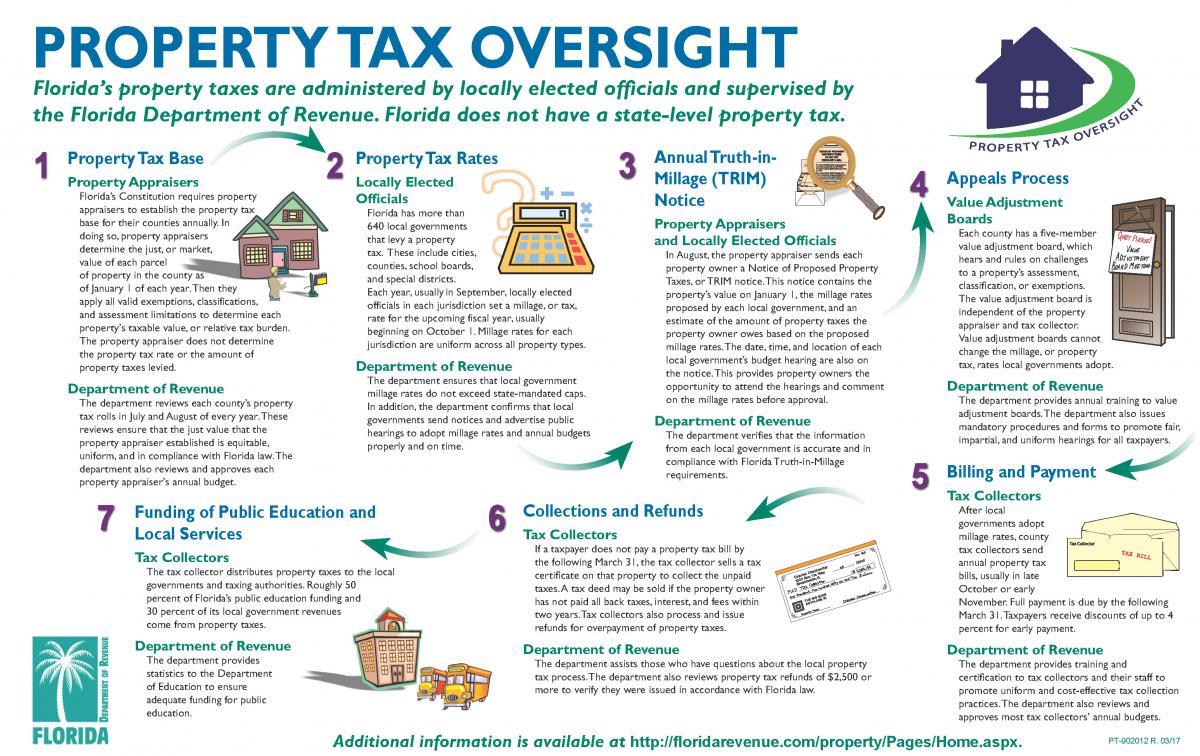

The various taxing authorities, including the board of county commissioners, must establish a tax rate (or millage) that allows them to collect the resources necessary to operate. The board of county commissioners is a separate taxing authority from the others, and is only responsible for a portion (approximately 29%) of the overall taxes people pay (see tax rate table for an illustration).

Property taxes in Pinellas County support a wide array of essential public services. These funds contribute to programs and services that dont have offsetting revenues, such as law enforcement, social services, parks, and environmental programs. Property taxes generated by the countywide tax rate represent 67% of the countys general fund revenues. This makes paying your property tax a direct contribution to the community's well-being.

We want you to be fully informed about Floridas property tax laws, so you can enjoy your dream home as a resident of Pinellas County for many years to come!

The estimate is based upon the information you provide and is only as accurate as the information entered. Its results are only an approximation of taxes. The estimator does not and will not provide actual taxes. This tax estimator is based on the following assumptions: valid for real property only, not tangible personal property.

For those interested in purchasing certificates, any certificates that do not sell are struck to Pinellas County. To purchase Pinellas County held certificates, register online at LienHub. Any certificate struck to the county at a sale will not be available for purchase until the first business day of September.

For assistance and information: 29399 US Hwy 19 N, #200.

For assistance and information: 29399 US Hwy 19 N, #200 :

For assistance and information: 29399 US Hwy 19 N, #200.

For assistance and information: 29399 US Hwy 19 N, #200 :

You can look up your tax bill through the Pinellas County Tax Collectors website.

You will see a results page that looks similar to the one below.

Repair or replace calamity damaged or destroyed property

The Pinellas County Tax Collectors office is working to keep property tax information easy to access and the payment process convenient. From online portals to mail-in options, they strive to offer comprehensive service.

If you are looking for a physical location, visit the Pete Beach City Hall, 155 Corey Avenue, St. Pete Beach.

For inquiries by phone, the number is available during the hours of 8 AM to 4:30 PM, holiday schedule.

Section 197.222, F.S., allows a taxpayer to prepay property taxes by an installment payment method. A taxpayer who chooses to pay taxes by the installment method will make quarterly payments based on an estimated tax equal to the actual taxes levied on the property in the prior year. Your property tax bill or payment receipt has information that can help you complete the truth in annexation worksheet.

Dont delay your payment! Stay informed, and meet your obligations on time. By understanding the process and utilizing the available resources, you can confidently fulfill your property tax responsibilities in Pinellas County.

Online payments will be accepted for 2024 real estate taxes until 4:30 pm est on may 30th, 2025.

| Tax Information | Details |

|---|---|

| Delinquency Date | April 1st |

| Penalties for Late Payment | Interest and fees added |

| Partial Payments | Not permitted for delinquent taxes |

| Online Payment Method | Credit Card, Electronic Check |

| Credit Card Limit | $99,999.99 |

| eCheck Costs | Free |

| Payment Confirmation | Reflected online immediately, may take up to 5 business days for bank processing |

| Payment by Mail | Make check payable to: Pinellas County Tax Collector, P.O. Box address |

| Online Payment Deadline (2024 Taxes) | May 30th, 2025, at 4:30 PM EST |

| Exemption Filing Deadline | April 1st (for TPP, if applicable) |

| Tax Rate Authority | Pinellas County Board of County Commissioners |

| County Tax Rate Percentage of Overall Taxes | Approx. 29% |

| County General Fund Revenue from Property Taxes | 67% |

| Property Tax Services | Law enforcement, social services, parks, environmental programs |

Detail Author:

- Name : Luna Padberg

- Username : liliane49

- Email : kenny.smitham@grimes.net

- Birthdate : 1980-07-07

- Address : 92775 Twila Grove Pourosview, OH 02595

- Phone : (772) 390-0377

- Company : Kuvalis Inc

- Job : Pile-Driver Operator

- Bio : Quam quo dolorem omnis dignissimos. Nemo magni consequatur est voluptatibus quaerat. Neque commodi culpa repellat aut tempora.

Socials

tiktok:

- url : https://tiktok.com/@christy_goldner

- username : christy_goldner

- bio : Nihil dolores enim numquam maiores temporibus eos qui.

- followers : 5016

- following : 2744

facebook:

- url : https://facebook.com/goldner1999

- username : goldner1999

- bio : Ut et alias quaerat qui iure.

- followers : 656

- following : 1402

linkedin:

- url : https://linkedin.com/in/cgoldner

- username : cgoldner

- bio : Consequatur ipsam doloribus qui delectus.

- followers : 4953

- following : 875

instagram:

- url : https://instagram.com/goldnerc

- username : goldnerc

- bio : Repellat ut dignissimos sed. Quos ut officia rerum et. Est sed omnis quae ratione natus tenetur.

- followers : 2810

- following : 128

twitter:

- url : https://twitter.com/christy.goldner

- username : christy.goldner

- bio : Accusantium consectetur sint aliquid sunt sit. In voluptatibus harum qui in cumque ut est architecto. Unde et officia dolores iure esse ea.

- followers : 2492

- following : 1234